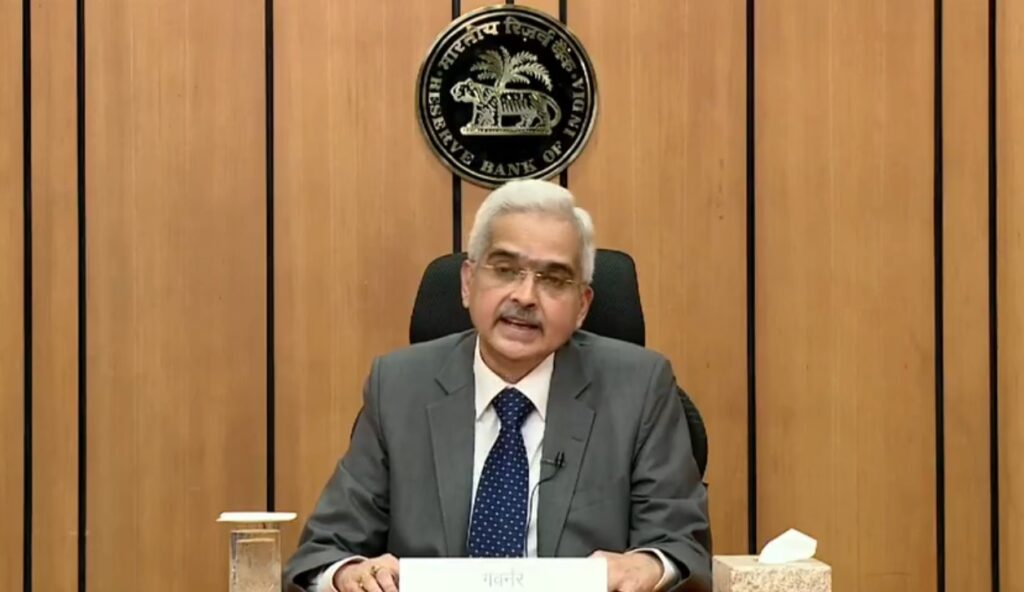

New Delhi : The inflation in India is expected to ease in a gradual manner in the second half of FY23, said Shaktikanta Das, Governor, Reserve Bank of India (RBI) on Saturday.

Speaking at the Kautilya Economic Conclave, organised by Institute of Economic Growth, New Delhi, Das said, with the supply outlook appearing favourable and several high frequency indicators pointing to resilience of the recovery in the first quarter (April-June) of 2022-23, the inflation may ease gradually in the second half of 2022-23, precluding the chances of a hard landing in India.

Tracing the history of inflation in India, Das said in early 2022 inflation was expected to moderate significantly to the target rate of four per cent by third quarter of FY23, with a projected average inflation rate of 4.5 per cent for 2022-23.

“This assessment was based on an anticipated normalisation of supply chains, the gradual ebbing of Covid-19 infections and a normal monsoon. The median inflation projection from the Survey of Professional Forecasters at five per cent for 2022-23 was also quite benign,” he said.

However, this was overtaken by the Russia-Ukraine war since February 2022, leading to a sharp spike in global crude oil and other commodity prices.

“Global food prices reached a historical high in March and their effects were felt in edible oil, feed cost and domestic wheat prices. The loss of Rabi wheat production due to an unprecedented heat wave put further pressures on wheat prices. Cost-push pressures were also aggravated by supply chain and logistics bottlenecks due to the war and sanctions,” Das said.

According to him, RBI’s objective was to safeguard the economy and preserve financial stability.

“Our endeavour has been to ensure a soft landing. These objectives continue to guide our actions even today and it will continue to be so in future,” he added.

Das said the benefits of globalisation come with certain risks and challenges. Shocks to prices of food, energy, commodities and critical inputs are transmitted across the world through complex supply chains.

“In fact, recent developments call for greater recognition of global factors in domestic inflation dynamics and macroeconomic developments which underscore the need for enhanced policy coordination and dialogue among countries to achieve better outcomes,” he said.

According to him, the insurance against such inevitable global shocks ultimately is built on sound economic fundamentals, strong institutions and smart policies. Price stability is key to maintaining macroeconomic and financial stability.

“We will continue to calibrate our policies with the overarching goal of preserving and fostering macroeconomic stability. In this endeavour, we will remain flexible in our approach while being cogent and transparent in our communication,” Das said.

Related Posts

Stock market special session today, Sensex jumps 120 points

Wipro appoints Sanjeev Jain as COO as Amit Choudhary moves on

JSW Steel posts 64 pc decline in Q4 net profit at Rs 1,299 crore