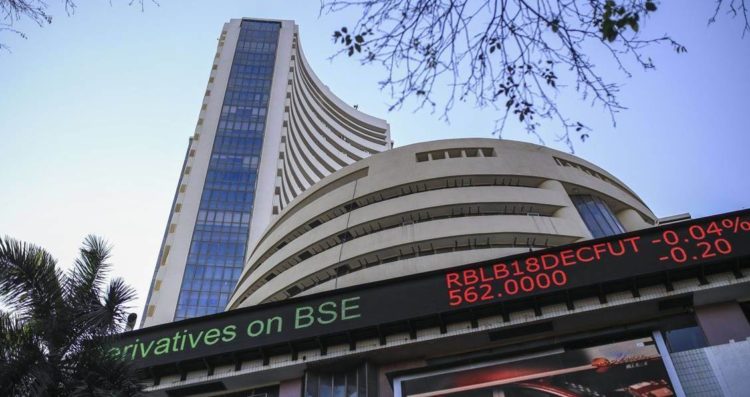

New Delhi : The BSE Sensex hit a fresh all-time high of 63,588 on Wednesday despite cautious global cues.

Even Nifty attempted to touch new highs, but fell short by 12 points. The index finally closed with a gain of 40 points at 18,857 points, said Siddhartha Khemka, Head of Retail Research, Motilal Oswal Financial Services.

Sectorally, it was a mixed bag with major buying seen in financial services, especially NBFCs. Consistent foreign inflows into Indian equities backed by the country’s strong macroeconomic data have driven investors’ confidence, Khemka said.

Vinod Nair, Head of Research at Geojit Financial Services, said that despite hitting record highs, the domestic market failed to sustain its upward trajectory due to prevailing concerns over global issues and a delayed monsoon.

Furthermore, market volatility was exacerbated by consecutive days of net selling by FIIs, while mid-cap stocks maintained their steady gains.

Jaykrishna Gandhi, Head – Business Development, Institutional Equities, Emkay Global Financial Services, said the Indian markets continued its resilient steady move with the market breadth widening and small and mid-caps touching new highs.

Flows into India remain strong with YTD flows of $5.5 billion as of Monday. The RBI/Fed paused in line with expectations as inflation both in the US and India is directionally moving in line with expectations.

Crude price weakness despite a second production cut by the Saudis is one area of concern with regard to the global economic health, especially in the second half of 2023. However, this bodes well for India as inflation will continue to remain low, Gandhi said.

“The flurry of block deals and the higher demand on most of the offerings do make us a little uncomfortable from a near term perspective. However, none of the indicators point at an overbought market as of now,” Gandhi added.

Related Posts

Indigo’s net profit drops 11.7 pc to Rs 2,728 cr in Q1, revenue up 17.3 pc

Sensex trades higher on positive global cues

SEBI study warns against intra-day trading risks in equity cash as young traders rise